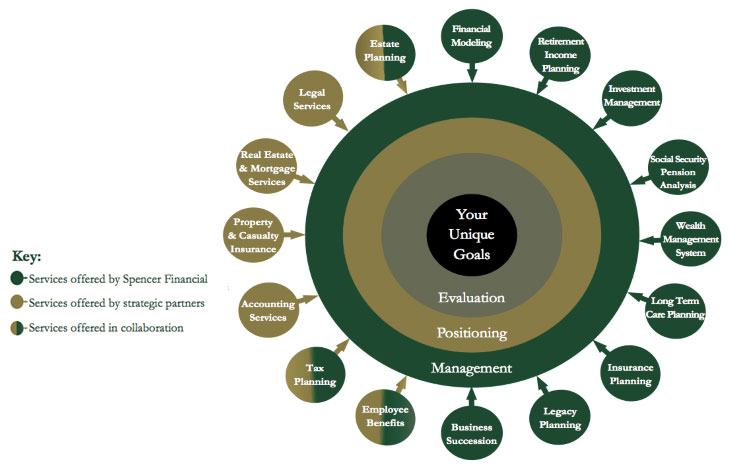

Our Process

Our process includes three parts:

1) Evaluation

Spencer Financial employs a comprehensive process of evaluating our client’s situation. We take into account the critical elements of a successful retirement plan, including current financial and personal circumstances, immediate and long-term goals, and our client’s specific retirement expectations.

2) Positioning

Our process entails positioning each element of the plan to reflect personal objectives, risk tolerance, and time frame. Our client’s compensation arrangements and existing employee benefit structure will be considered along with their personal choice of investment vehicles, asset allocation, and estate arrangements.

3) Management

Most important, our firm recognizes that no plan should remain static. As our client’s life and goals change, so must their planning strategies. A financial plan must have careful ongoing management to ensure that it adapts to changing circumstances.

Our advisory process is designed to align our client’s expectations about their financial future with realistic assumptions about their individual time frame, obligations and resources.